Registering to open a Visa Vietcombank card helps domestic and international transactions more conveniently, easily spend within the credit limit and receive many privileges without having to carry cash with you.

However, what are conditions for making Vietcombank credit card ? What is the procedure for making a specific Vietcombank credit card? What are the types of Vietcombank Visa cards to choose from? How to apply for a Visa card is complicated? Invite you to follow the article below to better understand:

Vietcombank VISA Platinum card

- Prepaying, paying later with the highest credit limit compared to many other card products. Even cardholders are entitled to 45 days free interest.

- Domestic spending and payment.

- Flexible statement payment method.

- Manage and control all spending transactions.

- Free annual fee in the first year, issue 1 more free debit card.

- Free change of credit limit, reissue card, issue card.

- Free transfer within the system, proactive SMS service, Internet Banking .

Normal Vietcombank VISA card

- Flexible limit for use from 5-300 million VND, spending first, paying later without interest up to 45 days.

- Each cardholder can open 3 supplementary cards.

- Pay for goods and services, withdraw money at any place that accepts VISA card or via Internet Banking online.

- Enjoy many privileges when paying all over the country, always provided notice of balance fluctuations.

Vietcombank Diamond Plaza Visa card

- Flexible use limit from 10-300 million.

- Free many card services such as replacement, change of credit limit, accumulated points.

- Comes with the same utilities and offers as Techcombank Visa.

Vietcombank Vietravel Visa Card

- All offers and utilities are like Diamond Plaza Visa card.

- Get many incentives when participating in programs combining travel company Vietravel and Vietcombank.

Vietcombank Saigon Center Card - Takashimaya

- There are full facilities and benefits of the standard / golden class Vietcombank Visa card.

- Receive many promotions when paying at shopping centers such as Saigon Center and Takashimaya - Japan.

Conditions for making a credit card of Vietcombank

- Be 18 or older.

- Be a Vietnamese citizen or a foreigner living and working in Vietnam.

- Having collaterals or actual monthly incomes of over VND 5 million or more, depending on the card category, the income level may vary.

Documents for making credit cards, Vietcombank Visa cards

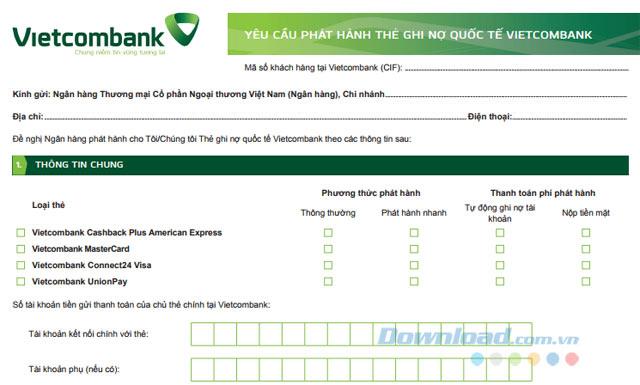

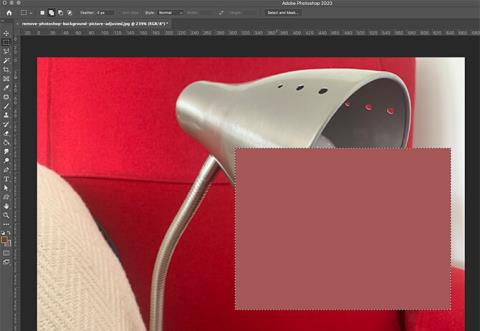

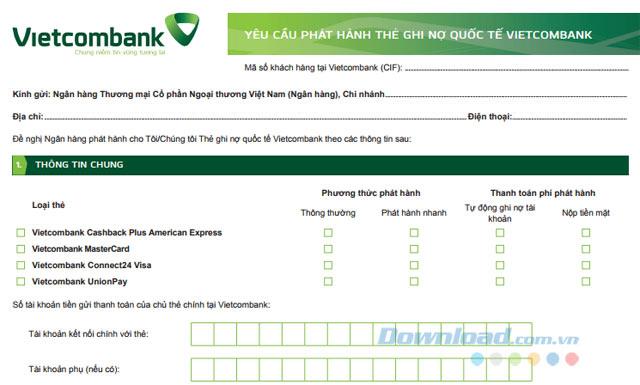

- Application for issuance and contract of using Vietcombank Visa card (bank model).

- A photocopy of 2-sided ID card / Passport, household registration (with the original for comparison).

- For foreigners, need to bring Visa / temporary residence card and confirmation of the working agency (original, stamped confirmation of the authorized representative in accordance with the form of Vietcombank).

- Copy of Visa showing the period of stay in Vietnam for foreigners.

- Proof of income suitable for applying for a Vietcombank VISA card

- Proof of income: Original bank transfer statement for the last 3 months or payroll from the workplace.

- For people without payrolls, there should be collaterals and papers proving the value of the products.

How to apply for a Vietcombank Visa card

After fully preparing the above documents, go to Vietcombank's transaction offices nationwide to make credit cards:

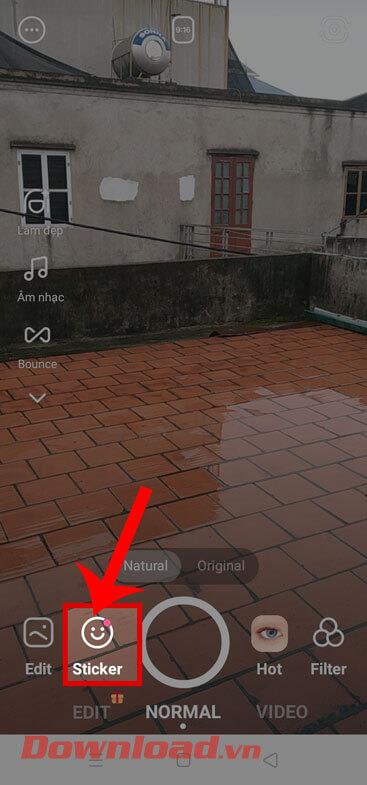

Step 1: Apply for a Vietcombank VISA card directly at Vietcombank branches / Transaction offices nationwide.

Step 2: Submit all required documents of the bank, then wait for the card after a few weeks.

Fee schedule of Vietcombank credit card

- Vietcombank credit card issuance fee ranges from 50,000 to 200,000 VND for each type of card.

- Annual fee of Vietcombank credit card ranges from VND 100,000 - VND 800,000 for primary card, from VND 50,000 to 500,000 for supplementary card

- The cash withdrawal fee at Vietcombank credit card ATM is 4% of the total withdrawal amount, minimum is 50,000 VND.

For those who need international transactions, spend a lot and regularly check Vietcombank account balances, opening Visa cards will be very convenient!

I wish you successful implementation!