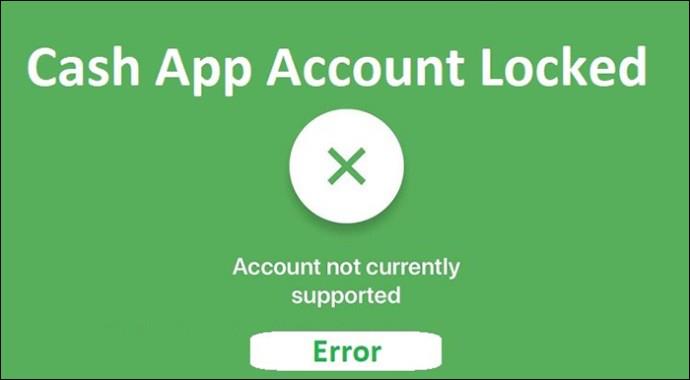

The collaboration between Cash App and traditional banks has streamlined the movement of funds without requiring manual input of credit card details. Be that as it may, Cash App bank transactions aren’t fail-proof. It’s common to get a frustrating error message that the bank declined your payment.

In this article, we’ll explain why you receive Cash App bank transaction errors and how to fix them.

What Makes Your Bank Decline a Cash App Payment?

When you receive a message that “Your bank has rejected this payment,” it means that the bank rejected the transaction and your money didn’t go through. There a several reasons why this happened, some of which you can fix manually, while some require you to contact your bank or Cash App.

Exceeding the Daily Transaction Limit

Like Cash App, banks impose a daily transaction limit that users can’t exceed. Usually, banks put these measures in place to protect you from fraud or unauthorized use.

Other times, the bank might reject your transaction if you send a large-than-normal amount to someone you’ve never transacted with before, even if you’ve not exceeded the limit. The reason being, the bank flags the transaction as suspicious.

You can fix this problem by doing the following:

- Contacting your bank: Email or call your bank to find out if the amount you want to pay exceeds the daily limit. If you’ve not exceeded the daily limit, but the bank has rejected your transaction, inform them it’s legitimate.

- Splitting the payment: If you’ve exceeded the transaction limit, divide the amount into multiple transactions you can send over several days without exceeding the daily limit.

- Asking the bank to increase your daily limit: Do you have a history of consistently transacting with huge amounts? You can confirm with your bank if you qualify for a raise in your daily transaction limit. But don’t be over-expectant because not all banks have this option.

Insufficient Funds in Your Bank Account

Having insufficient funds in your account is an obvious cause of a payment error. If the amount you’re trying to send exceeds the balance in your account, the transaction will be unsuccessful.

Sometimes, your account might show you have enough balance to facilitate a transaction, but you still get an error. This is due to pending transactions. Though pending transactions don’t become part of your account balance until the transaction is complete, they are deducted immediately from your available credit.

In this case, the solution is to pre-fund the bank account linked to your Cash App account with sufficient monies.

Suspicious Transaction

While the rise of digital transaction platforms has speeded up financial transactions, they’ve also opened up avenues for money laundering. As a result, banks have become more vigilant in protecting their consumers.

A bank will decline to process a transaction if it appears suspicious until you verify you’re the one trying to make it. For example, if you haven’t used your account for a month and make a payment involving a huge amount, the bank will decline it.

Other times, if you’re making payment to an account that the bank has flagged for scamming, your transaction will be unsuccessful.

In this case, you should contact the bank and inform them that the transaction is legitimate and you’re the one authorizing it.

Incorrect Card Details

If the card details you provided on your Cash App account don’t match the details associated with your account, the bank will decline the payment.

In this case, fix the issue by doing the following:

- Checking your card details: Ensure you have used the correct card number, billing address, and CVV. Re-enter the details again if you notice an error.

- Update Card information: If you’ve received a new card or your card information has changed, update the details in your Cash App account to avoid issues with outdated information.

- Checking your account’s expiry date: If it’s been a long time since you updated your card, verify that it hasn’t expired. An expired account is invalid and needs replacement.

Unverified Security Settings

Some banks place security measures that block transactions made through third-party platforms like Cash App. The security measures may block specific transactions or transactions within a specified geographical area.

To eliminate this as a possible cause of the payment decline, contact your bank and ensure there are no security restrictions on your account. Also, if your bank requires you to activate online transactions for your card, go to your online banking account or contact customer service to activate this feature.

Network and Connectivity Issues

Transmitting transaction data such as payment details, authentication tokens, or order information between Cash App and the bank is impossible without a network connection. Also, networks connect different devices and systems in the digital transaction ecosystem.

When you encounter a Cash App bank payment error, check if your device has a strong internet connection.

Bank Under Maintenance

It’s common for banks to undergo maintenance from time to time to integrate system and security updates for smooth and secure transactions. When this happens, banks shut down their services for a specified period, usually not more than three days. Any Cash App bank transaction during this period will be unsuccessful.

To verify if your bank is under maintenance, contact support or check on the bank’s official website.

Unverified Cash App Account

An unverified account is one that Cash App can’t link to a specific individual. With such an account, you can only make weekly payments worth $250. If you have exceeded this limit, the bank won’t process your transaction until your weekly limit is reset.

Also, an unverified account poses a security threat, and the bank may decline to process your transaction.

You need to verify your Cash App account to fix this issue. The verification process is simple. Try sending any amount above $250, and Cash App will prompt you to verify your account by providing your legal name, date of birth, and social security number. Once you verify your account, try making a Cash App bank payment to see if it’ll go through.

Technical Glitches With Cash App

Over time, your Cash App mobile app gets outdated, and you experience lags and crashes. These could disrupt payment processing and result in an error. Also, an outdated app could lead to problems syncing with your bank account, leading to payment failures.

The solution is to uninstall and reinstall the latest Cash App application. This resolves all issues that could be blocking the application from processing payments.

Resume Your Cash App Bank Payment

When you experience a Cash App bank payment error, know there are many possible causes. Some, like insufficient balance and network issues, are easy to identify and resolve. However, others call for professional support, and you should contact your bank or Cash App.

Have you ever experienced a Cash App bank payment error? If so, what was the problem and how did you resolve it? Let us know in the comments section below.