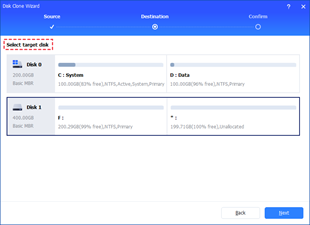

How to Copy Partition to Another Drive in Windows 11/10/8/7

In Windows 11, 10, 8, and 7, you can quickly copy a partition to a different drive using the flexible disk cloning tool AOMEI Partition Assistant.

Personal finance refers to managing your money as well as saving and investing it. It consists of budgeting, insurance, investments, tax, banking, and much more. Schools also offer courses in managing your money. Now the question is, how can you manage your money in this fast-moving life. You can’t take a paper and start writing everything. It will take a lot of time. The easiest way you can manage your money is through Personal Finance Software and Applications. It will save you time, and you can carry it anywhere.

Contents

8 Best Free and Paid Personal Finance Software

Personal Finance Software masters the basics and helps you become more efficient in saving your money. Choosing the Best Personal Finance Software mostly relies on your financial needs. So here are some paid and free Personal Finance Software to suit a variety of financial goals.

1. Quicken

At first, Quicken is one of the best paid Personal Finance Software out there. Earlier, when Quicken Inc. Launched the software it was available for free, but in 2018 it became a paid software. You can use the software to manage debt tracking, investment coaching, and much more.

Also, the software has an excel importing feature that allows you to perform calculations. Moreover, bill paying is one of the advanced features of quicken. Furthermore, it allows you to set up payment for your bills. The software helps you manage both personal and business expenses. Also, it is available for both iOS and Android.

2. Mint

Mint is proven to be the best for budgeting and expense tracking. Moreover, it allows you to set up alerts for things such as low balance and due date. It is quite easy to use, plus it has flexible budgeting tools that help you experiment in different scenarios.

Mint gives you real-time information on the amount you spent. Furthermore, it is free to download and is available for both iOS and Android. Also, it is available for desktops. It is easy to find help and support in this software.

3. Mvelopes

Mvelopes is a budgeting tool that helps you manage and track expenses using the envelope budgeting method. Furthermore, it automatically imports transactions. Also, it manages a wide range of financial accounts.

You need to pay at least $6 per month to use it, but even the basic plan has unlimited envelopes and lets you connect to many financial institutions. Moreover, it has connections with more than 16,000 financial institutions, including banks, investment companies, and much more.

4. YNAB

First of all, YNAB stands for You Need a Budget. This is best for habit building. The software provides you with tutorials that help you tackle some tough financial topics. YNAB offers a 34-day free trial. Moreover, the full software is $6.99 per month. YNAB helps you in keeping up with good financial habits.

The main idea is to balance the budget and to make sure that the necessary expenses are met. YNAB is a useful tool for learning the basic rules of budgeting and helping you plan for the expenses. Also, it is available for both iOS and Android.

5. TurboTax

TurboTax is an American tax preparation software. Michael A. Chipman developed this website in the mid-1980s. Moreover, it is one of the costly tax preparation tools, and it is consumer-friendly. Entering the tax information is quite simple, and you can import the information easily. TurboTax connects you with an Enrolled Agent who gives you personalized advice and answers questions about your tax return.

Some of the features of TurboTax are:

You can use TurboTax on the web, but for safety purposes, you should always download it.

6. FutureAdvisor

FutureAdvisor provides investment advisory services for client funds that are held through institutional management accounts. Moreover, it provides personalized recommendations to help your portfolio.

Also, it manages your assets and transfers it into the account for a flat annual fee of 0.5% of the managed assets, billed quarterly at 0.125%. It analyzes your current taxable accounts and proposes a rebalancing plan to reduce the cost of investing.

These are some of the accounts that FutureAdvisor supports:

7. Personal Capital

Personal Capital is a financial advisor and personal wealth management located in Redwood Shores, United States. It helps you manage all your financial accounts in a single platform. If you have a portfolio of more than $100,000, you can get personalized financial advice based on your goals. It helps you in telling whether you’re on track with your retirement and other investment goals.

Following are some of the features of Personal Capital:

If you’re not ready to take advantage of the financial advisor, you can use Personal Capital to track your investments in one place.

8. Tiller

Tiller links to your checking, credit card, loan, investment. It exports the data into a Google Sheet to perform your calculations on the data and download it into Excel. It lets you choose templates that organize your data for you. You can customize your spreadsheet to suit your needs. You can take advantage of the 30-day free trial.

Although the service costs $59 per year or $4.92 per month. It is a special application as it offers users the ability to put their unique spin on their finances. Tiller is an amazing tool for those who want automation and hands-on budgeting and want spreadsheets’ flexibility.

Conclusion

If you want to work on your financial plans, the above-mentioned software and applications are the best. With all these Personal Finance Software, you can make informed financial decisions anytime at any place.

In Windows 11, 10, 8, and 7, you can quickly copy a partition to a different drive using the flexible disk cloning tool AOMEI Partition Assistant.

Driver Booster 12 Free is an effective tool that will keep your computers drivers up to date, which will make the system run faster and more reliably. This driver updater from IObit keeps your PC running at its best by checking for lost, out-of-date, or broken drivers immediately.

In an era where digital efficiency is paramount, Advanced SystemCare 17 Free emerges as a beacon for those seeking to enhance their PC's performance.

Summary of Movies & TV application shortcuts on Windows 10, Summary of Movies & TV application shortcuts on Windows 10 to bring you a great experience. Maybe

How to fix Messages Failed to Load error on Discord for Windows, Discord isn't fun if you can't read what other people write. Here's how to fix Messages error

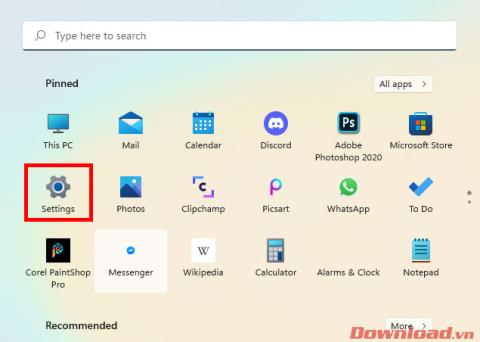

How to display the This PC icon on the Windows 11 desktop, During the process of using Windows 11, many users need to access This PC (management).

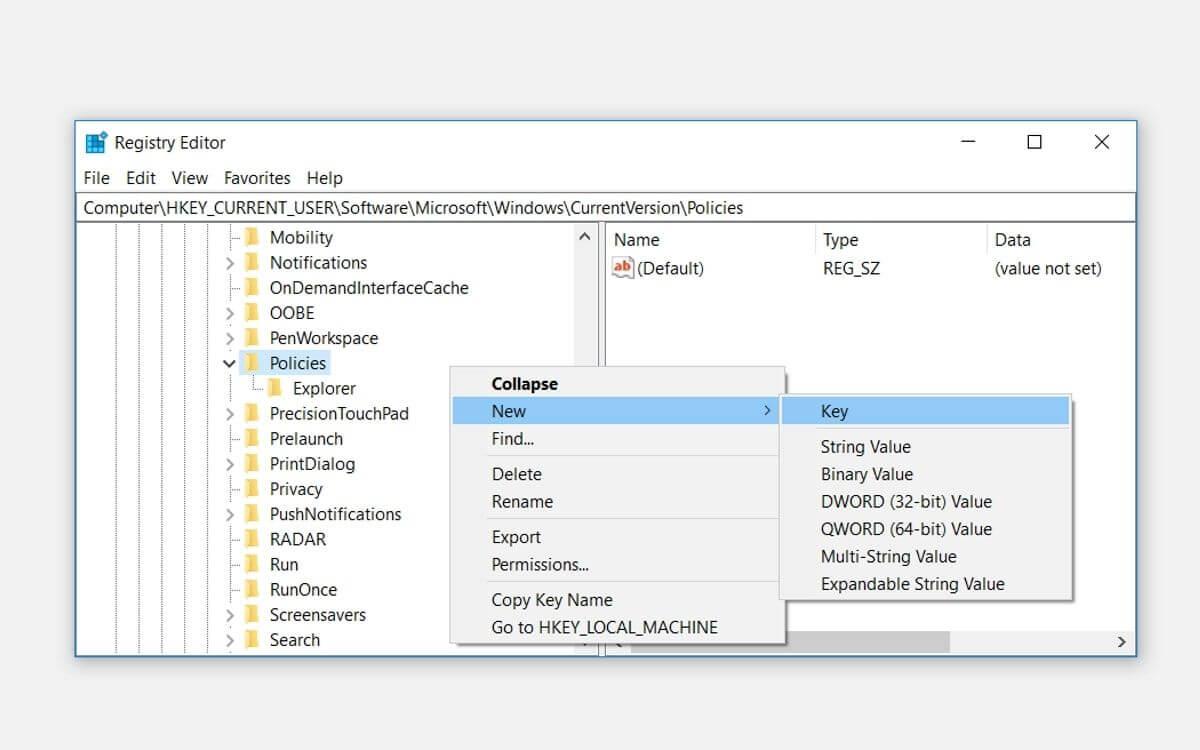

How to find information in the Windows Registry quickly, Do you find it difficult to find information in the Windows Registry? So below are quick ways to find the registry

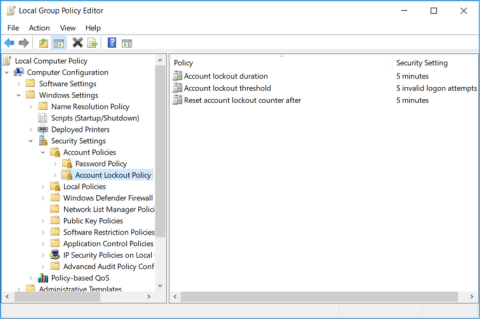

How to limit the number of failed login attempts on Windows 10. Limiting the number of failed password login attempts on Windows 10 helps increase computer security. Here's how

How to create fake error messages in Windows, Windows can come up with some pretty creative error messages but why don't you try creating your own content for them to make fun of?

Ways to open Windows Tools in Windows 11, Windows Administrative Tools or Windows Tools are still useful on Windows 11. Here's how to find Windows Tools in Windows 11.

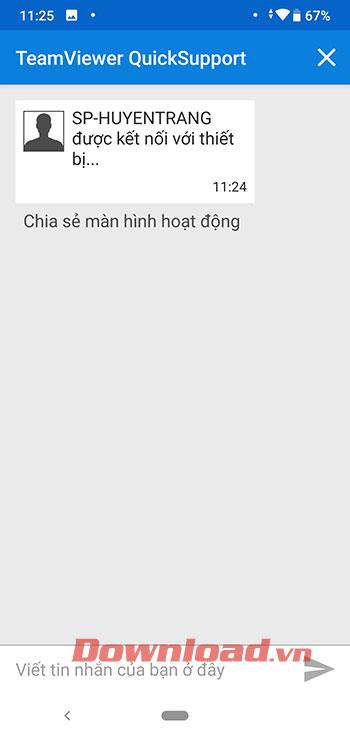

How to fix Windows Quick Assist not working error, Windows Quick Assist helps you connect to a remote PC easily. However, sometimes it also generates errors. But,

How to pin Word, Excel and PowerPoint files to the corresponding app icon on the Windows 11 taskbar, How to pin Office files to the taskbar icon on Windows 11? Invite

How to fix the error of not being able to install software on Windows, Why can't you install apps or software on Windows 10/11? Here's everything you need to know about how to fix it

Instructions for deleting or changing the PIN code on Windows 11, In Windows 11, the PIN code is a very useful and convenient security tool for users. However some people

How to fix There Are Currently No Power Options Available error in Windows 10, Can't select power mode in Windows 10, what should I do? Here's how to fix the error

The simplest way to fix Photos app errors on Windows 10, what should I do if Microsoft Photos doesn't work? Don't worry about ways to fix Photos app errors on Windows

Instructions for installing shortcuts to switch input languages on Windows 11. During the process of using Windows, users will often have to switch between methods.

How to check power status is supported on Windows 11, Windows 11 can handle many different power states. Here's how to check the power status

How to switch from 2.4GHz to 5GHz in Windows 10, If you want to find a quick and simple way to speed up the Internet, changing the WiFi band from 2.4GHz to 5GHz may help.

How to fix Not Enough Memory to Run Microsoft Excel error on Windows, Are you having an error of not enough memory to run Microsoft Excel? So, how to fix Not Enough Memory error