Today, the use of banking services to send as well as transact money gradually becomes popular with many people. When talking about banking, you may have heard the term "Internet banking" many times before but still wonder what it is. So let's learn all about Internet banking in the article below!

1. What is Internet banking?

Internet banking (online banking or e-banking) is a banking services online , allowing users to use the facilities of banking remotely, via electronic devices such as smartphones , laptops , desktop computers have Internet connection.

The security of customers' payment information when using Internet banking will be done through an OTP (one-time password) authentication code sent to the previously registered phone number.

With Internet banking, users no longer depend on banks, but can still use banking services anytime, anywhere.

2. Benefits of Internet banking service

Inheriting the advantages of the internet, Internet banking is much more convenient compared to traditional banks. No matter where you are, at any time, as long as you have a mobile device with internet connection and have previously registered to use Internet banking, you can fully use all the banking utilities. .

Some popular utilities that Internet banking provides to customers include :

- Query personal information such as account balance, money transfer history, transaction statements and bank information such as exchange rates, interest rates, ...

- Make money transfer back and forth between accounts at the same bank, interbank, transfer money via account numbers or card numbers.

- Pay for electronic bills such as electricity, water, internet, ...

- Link with e-Wallet services, withdraw and top-up money to use.

Simple savings, no cumbersome procedures needed.

- Some other benefits such as buying insurance and investing online.

3. Notes on using Internet banking

Although Internet banking is more convenient than traditional banking, in order to use Internet banking effectively, you need to pay attention to a few notes about account security as follows:

- Restrict the use of public devices to access its Internet banking. If you have used it, you must delete all transaction history and login information on that machine. However, to ensure safety, I recommend that you only use your devices to use Internet banking.

- Absolutely do not provide account-related information such as account number, PIN, ... to anyone (including bank staff).

- When making transactions on Internet banking, you will be provided with an OTP authentication code about your phone number, this code is secure and you should not share it to ensure the safety of your account.

- If possible, you should register for additional services such as SMS banking (a service that supports banking utilities through phone messages) to control and promptly handle problems related to your bank account. your item.

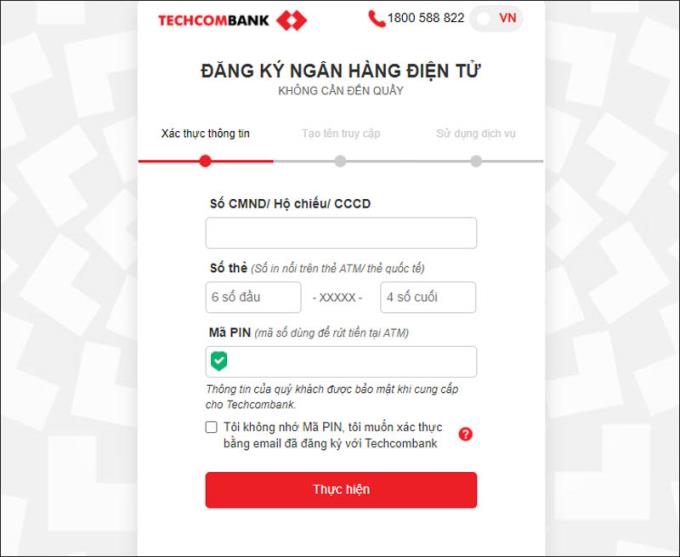

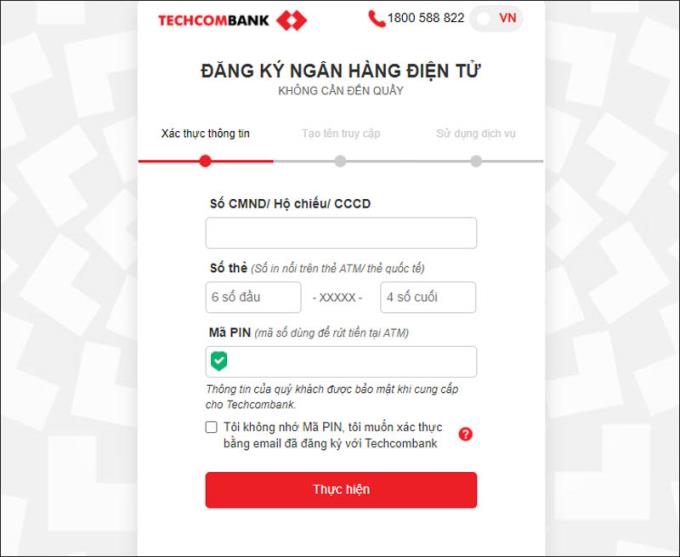

4. How to register Internet banking

You can do the same for banks that offer similar registration services. However, not all banks are the same, so I recommend that you go to the bank for more specific advice.

Recently, there is the Internet banking concept, the role of Internet banking and some notes when using this service. Hopefully the article is useful to you, wish you a great experience using Internet banking!