Causes and solutions for refrigerator light not lighting up

Your refrigerator light not coming on is usually due to three main activities that appear in this article.

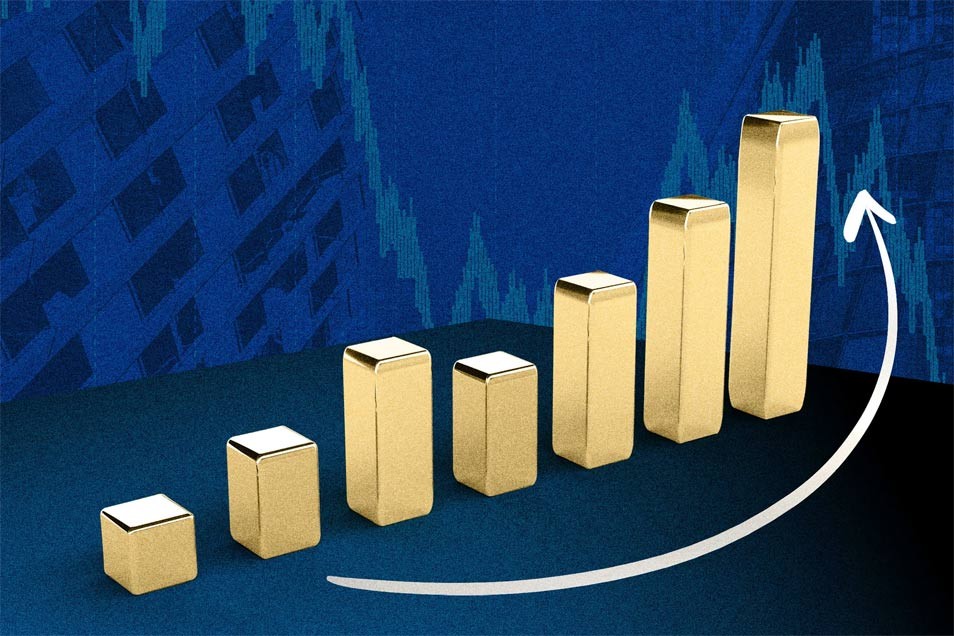

Gold prices hit an all-time high this week. Why are they so high? Let's find out!

The gold rush comes as markets around the world continue to panic over Trump’s tariffs, which are widely expected to raise prices for consumers. The trade war has also created huge uncertainty for businesses and investors. It has also fueled global tensions between the United States and its largest trading partners — and raised fears of a growing recession.

Here are three things to know about the forces driving the rise in gold prices.

Gold prices rise sharply due to tariffs

Gold prices have been rising steadily for years, but really peaked in early 2025.

Some analysts predict prices will continue to rise. Michael Widmer, head of metals research at Bank of America, published a report last week predicting gold prices will soar to $3,500 an ounce (0.829 ounces) in the next 18 months.

In an interview with NPR, Widmer said many factors have contributed to the multi-year rise in gold prices — but the recent surge is "almost entirely driven" by fear and uncertainty related to tariffs.

Gold may be known as a "safe haven" — but it can be volatile

Despite its price gains over the years, Widmer cautions that gold can be volatile. However, gold has long been seen as a safe haven in the so-called “fear trade.” As a precious metal that can be held (and hoarded!), gold offers a safe, solid look alongside stocks and other (often less physical) financial instruments.

“ When it looks like the world is about to collapse, gold often goes up, ” said Lee Baker, a financial planner, founder and CEO of Claris Financial Advisors in Atlanta.

But rushing to buy gold may not be right for everyone.

Baker warns that there are downsides to buying and owning gold — even during a crisis. For example, unlike stocks or bonds, buying gold doesn’t pay dividends or interest. So the only way to make money on this investment is to buy some and then hope to sell it later when the price rises.

Investing in gold also presents physical and logistical challenges — especially for those who want to buy physical gold. For example, buyers need to consider how to store their gold — and whether to pay for the security and insurance required to keep the precious metal in their home.

For those curious about gold but perhaps not ready to adopt a crisis-preparation lifestyle, Baker notes that it is possible to invest in gold-backed funds that do not require actual ownership of the precious metal.

However, “ if you’re buying gold right now just because you’re caught up in the craze, because the price of gold is going up — I would probably advise you to hold off ,” he said. “ Because it could lead to some disappointment .”

Baker said the current gold rush highlights a larger lesson about investing in more than one asset class, such as stocks.

“Don't put all your eggs in one basket. That applies to investing too.” “Diversification is important.”

Your refrigerator light not coming on is usually due to three main activities that appear in this article.

If you want to clean your oil heater and fan heater, you cannot miss our article below.

With just this seemingly useless ingredient, you can turn a dull blender blade into a sharp one in a snap.

Immortal Rising 2 Code can be exchanged for a series of rewards such as gems, chest keys, gems...

Metal Slug Awakening code helps players collect rewards when they first join the boss fight journey of 8x 9x gamers.

There are many statuses about long distance love on the Internet. This article will summarize for you meaningful love words for your lover far away that will make your lover's heart flutter.

Users no longer need to use the standalone Messenger app to text because Facebook has integrated the messaging platform back into the main interface of this social network.

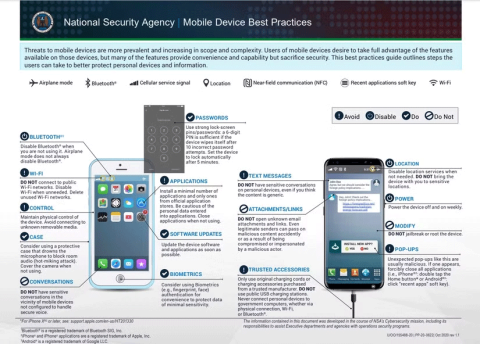

A new report suggests that restarting your phone is actually a good way to remove malware from your system.

Most of us only notice our tonsils when they become swollen or infected. Here are some facts you may not know about tonsils.

Dental floss is a common tool for cleaning teeth, however, not everyone knows how to use it properly. Below are instructions on how to use dental floss to clean teeth effectively.

A new algorithm called Estimate, Extrapolate, and Situate (EES), developed by researchers at the Massachusetts Institute of Technology (MIT), allows robots to train themselves and improve their skills without human intervention.

Code Yêu Quái: Chạy Đi Đi gives players a series of attractive codes with many different gifts.

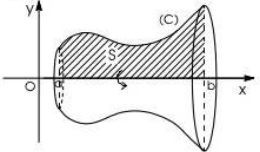

A solid of revolution is a shape created by rotating a plane around a fixed axis such as a cone of revolution, a cylinder of revolution, a sphere of revolution, etc. Below is the formula for calculating the volume of a solid of revolution, please refer to it.

Tiangong is described as the world's first full-size humanoid robot capable of operating solely on electric drive.

Some fish species have special abilities such as electrocution, smelling blood or changing sex...